Navy Federal Direct Deposit

The standard direct deposit authorization form is meant for all employees of the federal government including the military (Army, Navy, Air Force, Marines, etc.) as well as beneficiaries under government needs programs. This form will need to be filled out in triplicate as the Paying Entity, Financial Institution involved, and yourself must all have a copy for your records. With free expedited direct deposit service, all military service members, whether active or retired, will have access to their military Leave and Earnings Statement (LES) direct deposits as soon as Security Service Federal Credit Union receives notice from the Defense Finance and Accounting Services (DFAS), 1-3 days before their set posting date. The Navy Federal Credit Union (NFCU) direct deposit authorization form is a standard form which requires the basic information necessary to set up electronic fund transfers with an Employer and the Navy Federal Credit Union. Originally Answered: What time do direct deposits hit my Navy Federal account? From my several years of experience with Direct Depositing my paycheck with NF Your deposit will be credited the night it is transmitted to NF.

Navy Federal’s Mobile Deposit service is offered through our Mobile Banking. app, which requires you to provide a unique username and password each time you log in. Each item to deposit must be endorsed with the signature of the payee and “For eDeposit Only at NFCU.”.

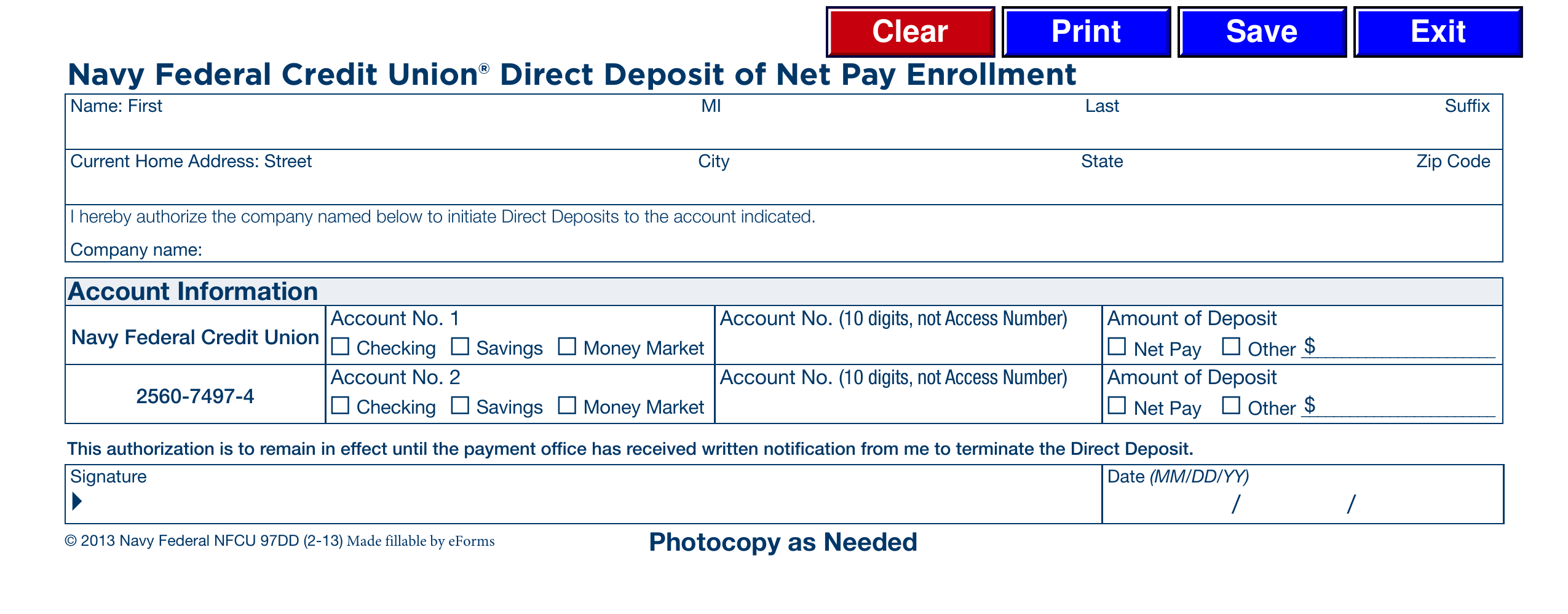

The Navy Federal Credit Union direct deposit form featured below is used for standard pay. That is, for those banking with Navy Federal Credit Union who are not on Active Duty, involved in the military, DoD, a DFAS employee, or working for a government agency. The purpose of a direct deposit form is to receive funds directly into your savings or checking account. Prior to completing the document, it is worth consulting with your employer’s HR/payroll department to ensure that a secondary or alternate form isn’t required, or that the option of direct deposit of income is available at the company.

- Direct Deposit – Online Enrollment

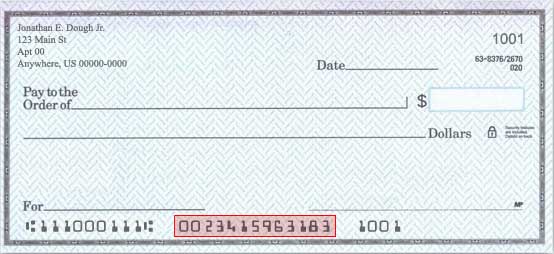

- Routing Number – 256074974

How to Write

Step 1 – Begin by downloading the form in PDF format.

Step 2 – In the first portion of this small form, your full name, current home address, and company name should be submitted clearly.

Step 3 – Under “Account Information,” there’s the option to add up to two (2) accounts into which the company will deposit funds. For each account, enter the type (checking, savings or money market), the account number, and the amount of the deposit.

Step 4 – The day’s date should be submitted before printing off the form. Sign the document and hand it into your company’s payroll or HR department with a voided check.

Many military friendly banks and credit unions offer early military pay direct deposit by as much as three days. Here are the banks and their early pay calendars for active duty and retired military pay.

Early Military Deposit Pay Calendars

Armed Forces Bank Early Pay Dates

Early Pay is a free, automatic direct deposit service we offer to military service members. Whether active or retired, all service members can have access to their Defense Finance and Accounting Services (DFAS) direct deposits one business day before the set pay date.

Navy Federal Credit Union Early Pay Dates

If you use Navy Federal Credit Union (NFCU) for your military pay deposit, when you see your pay depends on what type of checking account you use. NFCU has five kinds of checking accounts: Everyday Checking, Active Duty Checking, Campus Checking, e-Checking, and Flagship Checking. Only the Active Duty Checking account offers early crediting of military pay deposits.

Navy Federal Credit Union (NFCU) provides early direct deposit for only those members using an Active Duty Checking account, so there are two different pay deposit days for NFCU.

FrontWave Credit Union Advanced Pay & Military Days

FrontWave Credit Union (formerly Pacific Marine Credit Union (PMCU)) credits military pay deposits two business days prior to the actual military payday.

Navy Federal Direct Deposit Dates

Security Service Federal Credit Union

With free expedited direct deposit service, all military service members, whether active or retired, will have access to their military Leave and Earnings Statement (LES) direct deposits as soon as Security Service Federal Credit Union receives notice from the Defense Finance and Accounting Services (DFAS), 1-3 days before their set posting date.

Service Credit Union

Service Credit Union credits military pay deposits two business days prior to the actual military payday. It has 14 branches on U.S. military bases in Germany and has many customers who enjoy having a local branch bank at their overseas location.

“Immediate credit of your direct deposit to your Service Credit Union checking account up to two (2) days early is based upon when we receive your payroll from your employer. Service Credit Union cannot assume any liability for not depositing these funds to your account early.”

USAA Early Pay Dates

USAA offers crediting of direct deposit pay one business day before the actual payday. USAA pay deposits may credit at any time during the day. While they often credit in the early morning, that is not always true.USAA credits military pay one business day prior to the actual payday, contingent upon the receipt of deposit information from the appropriate pay agency.

Additional Banks with Early Pay Deposits

- AmericCU

- Andrews FCU

- Broadway Bank

- First Citizens Banks

- Fort Hood National Bank

- Kinetic Credit Union

- Langley FCU

- Point Breeze Credit Union

This is a partial list. Many more banks and credit unions offer early pay so if you don’t see your bank on this list be sure to inquire. Access to these banks is typically applicable to all branches of the military, including the Air Force, Air Force Reserves, Air National Guard, Army, Army National Guard, Army Reserves, Marine Corps, Marine Corps Reserves, Navy, Navy Reserves, Coast Guard, Coast Guard Reserves, Space Force, and the Public Health Service.

Another Big Reason to Bank at Military Friendly Banks

Government shutdowns can impact payments to active duty, Guard, Reserve and military retirees. Military friendly banks will often offer a no-interest, 0% Annual Percentage Rate (APR) payroll advance to military personnel with existing direct deposits. Banks can provide a onetime payroll advance loan to cover pay or benefits to the following groups, as long as those payments are direct deposited at the bank. This is at the discretion of each bank but historically many of the banks on this list have provided this benefit during a shutdown.

Finding the Best Bank for You

Many service members choose USAA, Navy Federal or PenFed (no early pay deposit offer) as the best choice for military banking. However, which bank to choose will often depend on your individual situation. Many service members end up opening accounts at one or more bank in order to take advantage of different benefits. For example, you might find that you prefer to keep your checking account at USAA for the early pay benefit, but apply for a car loan at PenFed or a home loan at Navy FCU.

Additional Advantages of Military Banks

- Low interest rates

- Reduced or waived fees

- No fee for counter checks, money orders, wire transfers, gift cards, foreign transactions or cashier’s checks

- Free safety deposit boxes

- No ATM Fees

- Special VA home loan and SBA loan options

- Savings on closing costs

- No monthly fees are charged on checking accounts

- Considerably higher percentage yields on savings accounts

- Free financial training programs

- Dedicated military customer service

When Will I Receive My Military Paycheck?

Military paychecks will normally be available on your payday. However, deposits may be available a day to three days earlier, depending on the financial institution. Since early pay varies by bank this most likely explains why it appears some people are getting paid earlier than others.

Plan ahead

While getting paid early can be great, it can also result in a long period of time until the next payday.

Navy Federal Direct Deposit Info

| Related Articles | |

| Military Retiree & Annuitant Pay Schedule | Armed Forces Comparative Pay Grades and Ranks |

| Military Pay Dates | Military Reserve Pay Dates |

| Military Pay Allowances List | Best VA Loan Lenders |

| Servicemembers Civil Relief Act Benefits | Companies who support the SCRA |