Free Checking Account No Credit Check No Deposit

Most brick and mortar banks today charge hefty fees and require a minimum deposit in order to qualify for a checking account. The great thing about online banks though, is that they are much easier to manage and as a result, many of them are completely fee-free. Free online checking account with no deposit is definitely something you should consider if you are low on cash or if you’re just tired of paying so much in bank fees.

We made a list of the best online banks with no fees and no minimum deposit. Not only do these banks offer totally free checking but they also have other checking account features that may come as a surprise! Check it out:

That’s right, there are no monthly service fees, no minimum balance requirements, unlimited check writing and no fees on checks/debits that clear. As if that wasn’t enough, with our free checking account, you have unlimited access to your funds using the Natco Credit. Open a credit union account at Mission Fed. All of our accounts offer a Platinum Debit Card with no monthly service fee, access to 30,000 surcharge-free ATMs including at many 7-Eleven Stores, 24/7 access via Online Banking and Mobile Banking, Mobile Deposit and Online Bill Pay with our free Mission Fed Mobile Banking apps, access to customer service via phone, secure messaging and Webchat.

Capital One offers a lot of products, from credit cards for fair credit and rebuilding to loans and deposit accounts. The 360 Checking account is the bank’s only (non-teen) checking account, but it packs in all the expected features without excess fees. 39,000 fee-free ATMs; Online transfers & direct deposit allowed; No monthly maintenance fees. No credit check or ChexSystems used. Depositing cash at participating retailers e.g. Walmart or 7-11 comes with a $4.95 fee. Opening an account at a retail location comes with a $2.95 fee and an. BBVA Free Checking comes with no monthly service charge, no ATM fees when using BBVA USA ATMs, plus a Visa® Debit Card, Online Banking and Mobile Banking all free. When you open this account, you also get free unlimited check writing and free paper statements.

Types of free online checking accounts

Interest-Paying Accounts

Some online banks have checking accounts that pay you interest on your balance. Even if you are one of those people that have a highly fluctuating balance, it’s still nice to get even a little interest on your money since it’s completely free.

Unfortunately, the interest rates on these online checking accounts tend to be very small, so even you have a decent and steady balance in your account, don’t quit your job yet.

The following two banks are fee-free, require no minimum deposit and pay interest on your checking account balance:

Capital One 360 Checking

Capital One 360 checking account is great because it charges you no fees, has no minimum balance requirements and will even pay you simple interest on your balance. You can also get an ATM card to use with it and Capital One has over 39,000 ATM’s in the USA that you will be able to use for free. In addition, you will also get online banking privileges, mobile check deposit and mobile banking. For balances under $50,000 the APR is 0.20%.

Ally Bank Interest Checking

Ally Bank will also pay you interest on your online checking account. It has a slightly lower 0.10% interest than Capital One’s 0.20% APR. The kicker is if you have more than $25,000 in your bank account the APR jumps top 0.60%. With this Ally Bank account you get free checks, online bill paying privileges and a MasterCard debit card.

Related Article: Banks with No Fees

Online checking accounts that have unique features

Some online banks offer a few unique features on their free checking accounts that other banks do not offer. These include things like cashback on purchases, rewards points, linked investment accounts and more. Here they are:

Discover Bank Cashback Checking

Here is an online checking account with a twist. With it you get 10 cents back for each check you write, bill you pay online and each purchase you make with your debit card. It will pay you up to $10 per month for these things. Along with its special features you also get a free debit card that cost you nothing to use at over 60,000 ATM’s and a free checking account.

Charles Schwab Bank High Yield Investor Checking

Here is a high yield investor checking account from the popular Charles Schwab Bank that also includes a brokerage investment account along with it. There are no fees or minimum account deposit requirements with it either. You will also receive 0.15% on your balance and the ability to transfer money effortlessly between your checking and investment accounts. This account also includes a debit card, mobile banking, online banking and online bill paying privileges.

Bank of Internet USA Essential Checking

Here is an online bank that not only offers a checking account with no fees, no minimum balance and pays you interest but it also has a rewards program attached to its use. You will get cashback deposited directly into your account when you shop at specified merchants. Its online banking site also has a host of special tools to help you manage your account.

Basic free checking account with no minimum balance

The following banks allow you to open an online checking account with no fees and no minimum balance but beyond that they only offer very basic features:

Simple Bank Simple Checking

What Bank Offers Free Checking With No Minimum Balance

This account from Simple Bank is aptly named because it’s just that – a very simple and basic banking account. All you get with it is no fees, no minimum daily balance requirement and a debit card you can use at over 40,000 ATM’s free of charge. There is not even simple interest paid on your account balance. Its online banking site does include some useful budgeting tools such as its Safe-to-Spend tool. This feature factors in upcoming pre-planned deductions, payments and spending into your account balance.

First National Bank First National Checking

This online checking account from First National bank offers you an account with no fees attached and it does not require a minimum balance. There are no ATM fees with it either, if you use it at an approved ATM. Checks are free as well and you get one forgiveness per year on an overdraft or returned check. You also won’t be charged for cashier’s checks or paper statements like you will be at most banks. Once you are a customer with this bank, you are eligible for discount rates on auto loans, personal loans, Certificates of Deposit and IRA accounts. There are also eligible savings on safety deposit boxes and mortgage closing fees.

The Huntington National Bank Asterisk-Free Checking

Asterisk-Free Checking from this bank is void of fees, requires zero minimum balance and does not charge ATM fees at specified machines. There is a sizeable $3 fee for using a non-approved ATM. They have only 1800 approved ATMs so make sure there is one near you before you sign up to bank with them. With Huntington National bank you can also transfer money easily between any types of account you have with them. This bank will also automatically draw funds from another account you can link to save you money on overdrafts.

Big Banks

Larger land based banks do usually offer totally free checking but there is a laundry list of stipulations with them. For example: with Wells Fargo, if you don’t maintain a minimum balance of $1,500 in your checking account you will be charged a $10 fee each month. Other banks such as Chase and Bank of America also have $1,500 minimum balance requirements that have even higher $12 fees when you don’t meet this requirement each month.

So what’s the bottom line here? It’s a fact that if you pick the right online checking account which fits your banking needs you can save over $100 per year and get other nice benefits too.

Is there any way to open a checking account online with no deposit? Yes, there is! Some banks won’t work with people who have very little money, but according to the FDIC, 93% of all Americans have a checking account. It’s almost a necessity for doing business in today’s world. Some employers refuse to issue a paper check, insisting on electronic deposits. Many services demand that their payments be scheduled via bank draft. And you can’t have a debit card without a bank account. But, with many banks, you have to have hundreds of dollars to open an account, and that is just not always possible! That’s why you need to find a bank online that will let you have a checking account with no deposit.

Credit Checks

Did you know that banks report to credit agencies? They do, and they have one in particular that they use to communicate with other banks: ChexSystems. ChexSystems is the credit reporting agency used by most banks to keep record of your checking account’s activity. For example, if you have frequent insufficient funds, your bank will report you. If you have frequent overdrafts, your bank will report you. Even if you just have trouble maintaining a minimum balance, your bank will report you. They can ruin your credit ranking just based on your behavior with your checking account.

ChexSystems keeps your banking records for 5 years. That is a long time to have something on your record that could affect whether or not you can get a checking account. About 15% of people who apply for a checking account are denied because of their reports filed with ChexSystems.

But it doesn’t stop with ChexSystems. Many banks will check your credit report. They may deny you a checking account if you have a low credit score. And, all of this when you just need someplace to deposit your paycheck!

If you have a history of problems with your checking account, don’t give up. There are many options that will let you open a checking account with no deposit. Furthermore, there are several banks that don’t even use ChexSystems. You just need to find those free checking account with no deposit and not credit check or second-chance checking accounts.

Free Checking Account No Credit Check No Deposit

Sometimes your brick-and-mortar bank will have checking accounts with no fees, but it’s not very common. Most online checking accounts, though, are great about low cost, no fee services. Here are some of the banks that offer free checking accounts with no credit check and no deposit:

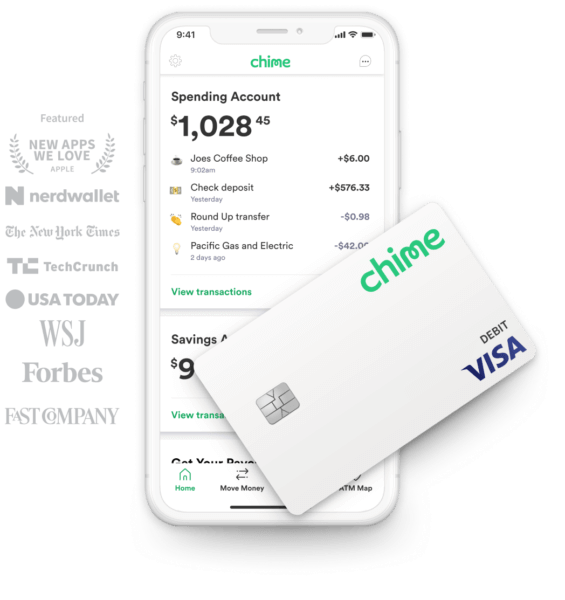

- Chime Checking

- GoBank

- Independent Bank

- BankMobile

- TD Ameritrade

- Axiom Bank

LEARN MORE>> The guide to open a free online checking account with no deposit

Second Chance Banking

Some banks will offer second-chance account services. You could find these services at your local bank or at an online bank (as some of the banks mentioned in the last section). In any case, you should look for accounts that offer the following features:

- No monthly service fee

- No minimum deposit

- No minimum balance

- Low-cost optional overdraft protection

- ATM use with no fee

- No transaction fees with debit cards

Some of these banks even offer .1% or .2% interest on your balance! That means that they ADD money to your account for as long as you have money there.

READ MORE>> How to open an online checking account instantly

LEARN MORE>> You decided to open a bank account? Find out about online checking account interest rates to learn how to earn cash even when your money is parked in your account

Open bank account online no deposit bad credit

We’ve explained how and why the way you previously handled your checking account can make it difficult to open a new account. Yes, there are plenty of banks that will open up a checking account for you without expecting a deposit, but not all of these banks will provide you with an account if your ChexSystems report or your credit report comes back with something that concerns the bank.

So, what do you do if you have bad credit and no deposit? Can you even open an account online? You can, you just need to be selective about which banks you apply at. First, if you have absolutely no money to start an account with, consider Chime Bank, a second-chance account provider that lets you open an account with $0 for a deposit, and which will consider you even if your credit record is poor.

Free Checking Account With No Deposit

Have $10 for a deposit? Radius Bank will open an Essential Checking account for you to help you rebuild your credit score. You have a lot more options if you have a deposit of $25. All of which will allow you to open an account no matter your bad credit or checking account problems. Consider Wells Fargo’s Opportunity Checking account, BBVA’s Compass ClearChoice Free Checking and also the First National Bank and Trust Company’s Renew Checking account.

Fair Credit Reporting Act

What Bank Has Free Checking Accounts

If your bank refuses to give you a checking account, find out why. And if your bank keeps you in the dark about why you have been refused a checking account, you have the Fair Credit Reporting Act to back you up. This act requires banks to tell you why they are denying you a bank account.

Free Checking Account No Credit Check No Deposit

Online checking accounts are seen by many as the wave of the future. Don’t struggle with obstinate tellers and loan officers in your city. Go online and get a checking account with no deposit and no fees. It makes life easier, and you can do your banking from your phone.