Dbs Savings Account Interest Rate

© Provided by MoneySmart Fixed deposit (sometimes called time deposit) accounts are low-risk investments that earn you interest over a fixed commitment period. You don't need to do anything to earn this interest, just park your money with a bank. Think of it like mold on a piece of bread. Just leave it out in the open and mold will grow — FREE! — on your bread for you.

Fixed deposit board rates are usually very low, but every month, many banks come up with fixed deposit promotions to offer good rates. In 'normal', non-Covid-19 times, promotional fixed deposit rates can go up to 1.8% to 2% p.a. However, with the current sluggish economy, fixed deposit interest rates remain low — although they might still be better than savings accounts.

Ever since COVID-19 hit our economy, DBS has been one of the consistent winners when it comes to fixed deposit rates. This month is no exception. The current highest DBS fixed deposit rate of 1.3% p.a. is considered sky-high by today's standards. The minimum of $1,000 is is quite a manageable amount, although you have to commit to a tenure of 18 months. Otherwise, you can still get a slightly lower interest rate of 1.15% p.a. for 12 months. DBS is the best out there this month given the current economic climate and decreasing interest rates all around. It’s a good option if you want to save up and prefer local banks. [ms-inline-widget account_type='fixed-deposit' amount='10000' tenure='18' locale='en' country_code='sg' channel='fixed-deposit' product_slug='dbs-singapore-dollar-fixed-deposit' ]

The next best alternative to DBS is usually a  Maybank fixed deposit. In February, you can earn 1% p.a. with Maybank's Singapore Dollar Time Deposit. Unfortunately you have to leave it in for 36 months (3 whole years!) to earn that measly 1% p.a. [ms-inline-widget account_type='fixed-deposit' amount='10000' tenure='24' locale='en' country_code='sg' channel='fixed-deposit' product_slug='maybank-singapore-dollar-time-deposit' ]

Maybank fixed deposit. In February, you can earn 1% p.a. with Maybank's Singapore Dollar Time Deposit. Unfortunately you have to leave it in for 36 months (3 whole years!) to earn that measly 1% p.a. [ms-inline-widget account_type='fixed-deposit' amount='10000' tenure='24' locale='en' country_code='sg' channel='fixed-deposit' product_slug='maybank-singapore-dollar-time-deposit' ]

Apart from the big banks like DBS, UOB and OCBC, the fixed deposit aficionado should also look at non-bank financial institutions like Hong Leong Finance as they also offer promotions. They may not be quite as risk-free as banks, though. This month, Hong Leong is offering 0.75% p.a. for 24 months, 0.68% for 18 months, or 0.6% for 12 months, but it also requires a significantly larger sum of $20,000. Before you lock up that much in a fixed deposit, make sure you have sufficient emergency funds first.

Apart from the big banks like DBS, UOB and OCBC, the fixed deposit aficionado should also look at non-bank financial institutions like Hong Leong Finance as they also offer promotions. They may not be quite as risk-free as banks, though. This month, Hong Leong is offering 0.75% p.a. for 24 months, 0.68% for 18 months, or 0.6% for 12 months, but it also requires a significantly larger sum of $20,000. Before you lock up that much in a fixed deposit, make sure you have sufficient emergency funds first.

It used to be that you needed at least $20,000 lying around in order to benefit from the higher promotional interest rates. However, now that the general rates have gone down, suddenly the lower-commitment options are a lot more competitive. All the above fixed deposits have pretty low barriers to entry, but Chinese bank ICBC takes the cake by requiring just $500 minimum deposit. You get an okay-ish 0.6% p.a. (if you apply for this fixed deposit online) with a commitment period of 12 months.

It used to be that you needed at least $20,000 lying around in order to benefit from the higher promotional interest rates. However, now that the general rates have gone down, suddenly the lower-commitment options are a lot more competitive. All the above fixed deposits have pretty low barriers to entry, but Chinese bank ICBC takes the cake by requiring just $500 minimum deposit. You get an okay-ish 0.6% p.a. (if you apply for this fixed deposit online) with a commitment period of 12 months.

Oh dear, local banks UOB and OCBC (see below) certainly fall short of DBS when it comes to fixed deposit rates of late. Right now, UOB is offering only 0.5% p.a. on their 10-month fixed deposits. The saving grace is that the lock-in period is relatively short. [ms-inline-widget account_type='fixed-deposit' amount='10000' tenure='11' locale='en' country_code='sg' channel='fixed-deposit' product_slug='uob-singapore-dollar-fixed-deposit' ] Note that if you have an UOB fixed deposit that's maturing this month, UOB will auto-renew your account at the current 'promotional' rate. You might want to check and update your standing instructions.

If you have $25,000 to spare, but don't want to lock it up the whole year, Standard Chartered has a 3-month fixed deposit promotion that lets you earn 0.45% p.a. [ms-inline-widget account_type='fixed-deposit' amount='10000' tenure='3' locale='en' country_code='sg' channel='fixed-deposit' product_slug='standard-chartered-singapore-dollar-time-deposit' ]

OCBC fixed deposit interest rates are lower than UOB's, offering 0.4% p.a. for minimum $20,000 deposit for at least 12 months. [ms-inline-widget account_type='fixed-deposit' amount='10000' tenure='24' locale='en' country_code='sg' channel='fixed-deposit' product_slug='ocbc-time-deposit-account' ]

Tying with OCBC for 7th place is Malaysian bank RHB. Like OCBC, its 0.4% p.a. interest rate is really not spectacular, so think carefully before you commit for the full year. [ms-inline-widget account_type='fixed-deposit' amount='10000' tenure='36' locale='en' country_code='sg' channel='fixed-deposit' product_slug='rhb-singapore-dollar-fixed-deposit' ]

- Interest Calculation. The interest amount is calculated daily based on our published rate here. The interest amount earned will be paid into your account on a monthly basis. The minimum amount required to start earning interest is NT$5,000.

- Features of DBS Treasures Savings Account 1. You can easily access your savings account from your mobile device or ATM. You can avail interest on your savings starting from 3.5% to 6% p.a. However, this also depends on your bank balance. Everyone is a Priority.

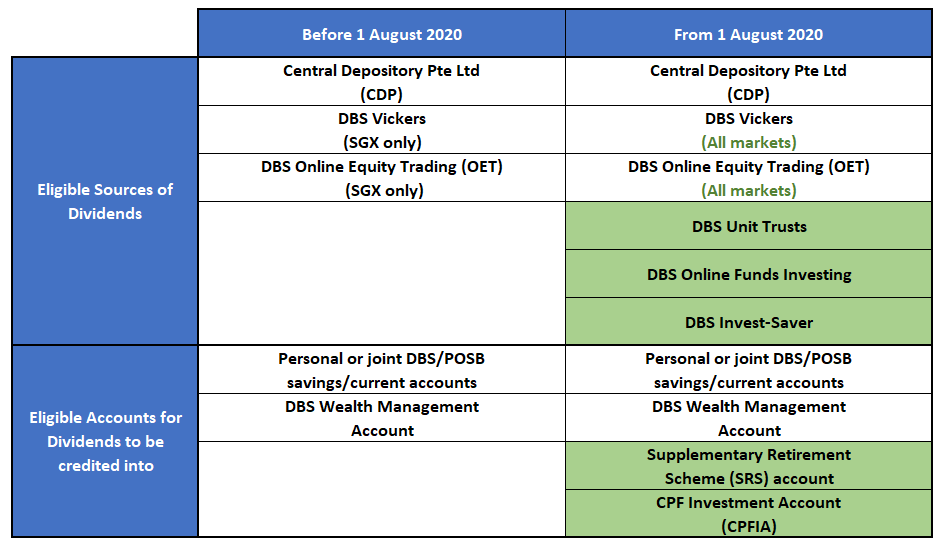

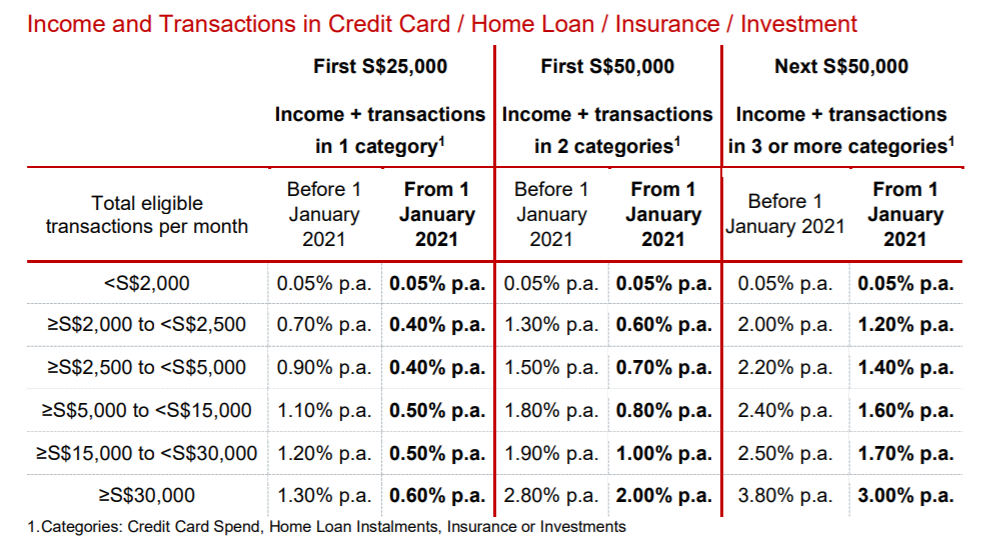

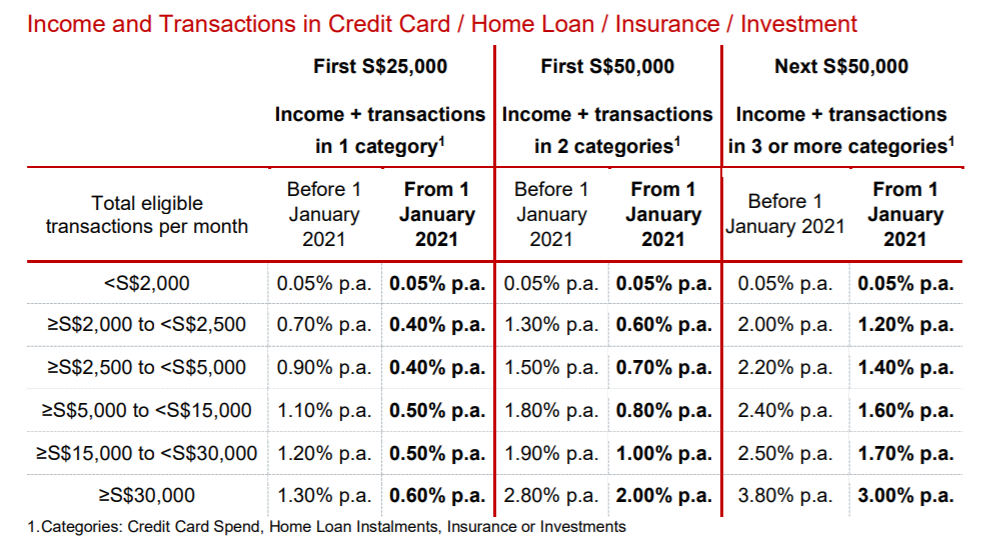

If your transactions do not meet the criteria, S$ balance in your DBS Multiplier Account will be accorded the prevailing interest rate for that month. The higher interest rates of up to 3.00% p.a. Are applicable only up to the first S$100,000 in the.

Best fixed deposit rates in Singapore (Feb 2021)

We've picked the highest fixed deposit rates for SGD in attainable deposit amounts (i.e. $50,000 and below). Note that these promotional rates change monthly and the bank can change the rates anytime.| Bank/financial institution | Min. deposit amount | Tenure | Interest rates |

| DBS | $1,000 | 18 months | 1.3% p.a. |

| Maybank | $1,000 | 36 months | 1% p.a. |

| Hong Leong Finance | $20,000 | 24 months | 0.75% p.a. |

| ICBC | $500 | 12 months | 0.6% p.a. |

| UOB | $20,000 | 10 months | 0.5% p.a. |

| Standard Chartered | $25,000 | 3 months | 0.45% p.a. |

| OCBC | $20,000 | 12 months | 0.4% p.a. |

| RHB | $20,000 | 12 months | 0.4% p.a. |

| CIMB | $1,000 | 3 months | 0.3% p.a. |

| HSBC | $30,000 | 6 months | 0.25% p.a. |

DBS fixed deposit rates (Feb 2021)

| DBS fixed deposit rate | |

| Interest rate | 1.3% p.a. |

| Deposit amount | $1,000 to $19,999 |

| Tenure | 18 months |

Maybank fixed deposit rates (Feb 2021)

| Maybank fixed deposit rate | |

| Interest rate | 1% p.a. |

| Deposit amount | Min. $1,000 |

| Tenure | 36 months |

Hong Leong Finance fixed deposit rates (Feb 2021)

| Hong Leong Finance fixed deposit rate | |

| Interest rate | 0.75% p.a. |

| Deposit amount | Min. $20,000 |

| Tenure | 24 months |

Apart from the big banks like DBS, UOB and OCBC, the fixed deposit aficionado should also look at non-bank financial institutions like Hong Leong Finance as they also offer promotions. They may not be quite as risk-free as banks, though. This month, Hong Leong is offering 0.75% p.a. for 24 months, 0.68% for 18 months, or 0.6% for 12 months, but it also requires a significantly larger sum of $20,000. Before you lock up that much in a fixed deposit, make sure you have sufficient emergency funds first.

Apart from the big banks like DBS, UOB and OCBC, the fixed deposit aficionado should also look at non-bank financial institutions like Hong Leong Finance as they also offer promotions. They may not be quite as risk-free as banks, though. This month, Hong Leong is offering 0.75% p.a. for 24 months, 0.68% for 18 months, or 0.6% for 12 months, but it also requires a significantly larger sum of $20,000. Before you lock up that much in a fixed deposit, make sure you have sufficient emergency funds first. ICBC fixed deposit rates (Feb 2021)

| ICBC fixed deposit rate | |

| Interest rate | 0.6% p.a. |

| Deposit amount | Min. $500 |

| Tenure | 12 months |

It used to be that you needed at least $20,000 lying around in order to benefit from the higher promotional interest rates. However, now that the general rates have gone down, suddenly the lower-commitment options are a lot more competitive. All the above fixed deposits have pretty low barriers to entry, but Chinese bank ICBC takes the cake by requiring just $500 minimum deposit. You get an okay-ish 0.6% p.a. (if you apply for this fixed deposit online) with a commitment period of 12 months.

It used to be that you needed at least $20,000 lying around in order to benefit from the higher promotional interest rates. However, now that the general rates have gone down, suddenly the lower-commitment options are a lot more competitive. All the above fixed deposits have pretty low barriers to entry, but Chinese bank ICBC takes the cake by requiring just $500 minimum deposit. You get an okay-ish 0.6% p.a. (if you apply for this fixed deposit online) with a commitment period of 12 months. UOB fixed deposit rates (Feb 2021)

| UOB fixed deposit rate | |

| Interest rate | 0.5% p.a. |

| Deposit amount | Min. $20,000 |

| Tenure | 10 months |

Standard Chartered fixed deposit rates (Feb 2021)

| Standard Chartered fixed deposit rate | |

| Interest rate | 0.45% p.a. |

| Deposit amount | Min. $25,000 |

| Tenure | 3 months |

OCBC fixed deposit rates (Feb 2021)

| OCBC fixed deposit rate | |

| Interest rate | 0.4% p.a. |

| Deposit amount | Min. $20,000 |

| Tenure | 12 months |

RHB fixed deposit rates (Feb 2021)

| RHB fixed deposit rate | |

| Interest rate | 0.4% p.a. |

| Deposit amount | Min. $20,000 |

| Tenure | 12 months |

What about HSBC and CIMB fixed deposits?

The rest of the banks — CIMB and HSBC — are offering 0.3% or less on their fixed deposits, which is hardly worth your time. In fact, you can get 0.3% p.a. on your savings with no lock-in just by opening a regular CIMB FastSaver account. Of course, banks are notoriously fickle about their interest rates, and all these could easily change next month. For the latest promotional rates, remember to bookmark this page and our MoneySmart fixed deposit comparison page before you commit.Dbs My Savings Account Interest Rate

Plus, here’s a quick and dirty summary of what you need to know about fixed deposits.Fixed deposit vs savings account — what's the difference?

https://youtu.be/Sq9hjlnEgY0 Once an attractive alternative to that pathetic 0.05% p.a. interest on savings accounts, fixed deposits — like so many ageing Channel 8 starlets — are fading from collective memory. Today, every bank in Singapore is competing for your dollar with high interest savings accounts, which may actually offer better returns. Here are the differences between fixed deposits and savings accounts at a glance:| Fixed deposit | Savings account | |

| Tenure | As low as 3 months, but go for at least 12 months for better rates | None |

| Interest rate | The longer the tenure, the better the interest rate | Usually the same regardless of tenure |

| Amount to deposit | Fixed amount, usually at least $10,000 | Smaller initial deposit and minimum monthly balance ($500 to $3,000) |

| Currency | SGD by default, but some banks offer higher interest rates for foreign currency | SGD by default. There are a few multi-currency accounts, but no difference in interest rate |

| Can you withdraw? | Contrary to popular belief, yes, but you lose the interest | Yes, no impact on interest, but don’t fall below the minimum balance |

| Interest payments | Quarterly or annually | Monthly |

| Risk level | Virtually risk-free, insured up to $75,000 by Singapore Deposit Insurance Corporation (SDIC) |

Fixed deposit vs Singapore Savings Bonds (SSB) — which is better?

In an earlier article, we compared the Singapore Savings Bonds to fixed deposits. There are a few key distinctions between these virtually risk-free investment vehicles. First, interest rates. Believe it or not, fixed deposit interest rates are actually higher than SSBs. The November issue of SSBs offers a measly 0.23% p.a. interest average return after the first 2 years, which you can easily beat with a well-chosen fixed deposit promotion. Next, entry point. It takes just $500 to invest in Singapore Savings Bonds, which is lower than the $1,000 or more for most fixed deposits. That said, ICBC fixed deposits only require $500 to start. (On the flip side, there's a cap of $200,000 you can put into Singapore Savings Bonds. There's no cap for fixed deposits.) Finally, tenure.Dbs Savings Account Interest Rate

Fixed deposits are shorter term investments. After the lock-in period is over, you should shop around again for another place to park your money. With SSBs, however, the interest rate climbs every year, so the longer you keep the money in there (up to a maximum of 10 years) the more you get. At the same time, SSBs have higher liquidity than fixed deposits. You will not be penalised if you withdraw your money at any point. You do have to pay a $2 transaction fee each time you buy or redeem a bond, though.Dbs Savings Account Interest Rate Calculator

Know anyone who likes to park their cash in fixed deposits? Share this article with them. [ms_related_articles] The post 7 Best Fixed Deposit Rates in Singapore (Feb 2021) — DBS, Maybank & More appeared first on the MoneySmart blog.MoneySmart.sg helps you maximize your money. Like us on Facebook to keep up to date with our latest news and articles.