Charles Schwab Cd Rates

Overview of Schwab CDs. Charles Schwab offers brokered CDs with competitive rates. Through the firm’s platform, you can open CDs with interest rates as high as 0.15% depending on the term. These offerings launch Schwab to the head of the competition when it comes to CDs.

Charles Schwab is a multinational financial services company founded and headquartered in San Francisco, California.

- Certificates of deposit available through Schwab CD OneSource typically offer a fixed rate of return, although some offer variable rates. They are FDIC-insured and offered through Charles Schwab & Co., Inc. Charles Schwab Bank and Charles Schwab & Co., Inc. Are separate but affiliated companies and subsidiaries of The Charles Schwab Corporation.

- Charles Schwab Bank, SSB is an FDIC insured bank located in Westlake and has 307945000 in assets. Customers can open an account at one of its 12 Branches. Charles Schwab Bank, SSB Customer Reviews, Frequently Asked Questions, Rates.

- Charles Schwab 1 Year CD Rates - Deposits. Q: What is your best CD interest rate for 18mths. Reply. Stan from Alma, United States. 3 years ago. Charles Schwab 1 Year CD Rates - Deposits.

They’ve built up quite an impressive sum of assets under management since their inception in 1971 with just over $3.3 trillion and counting.

Charles Schwab has an array of products and services that it offers to both retail and institutional clients encompassing commercial banking, stock brokerage, and wealth management advisory services.

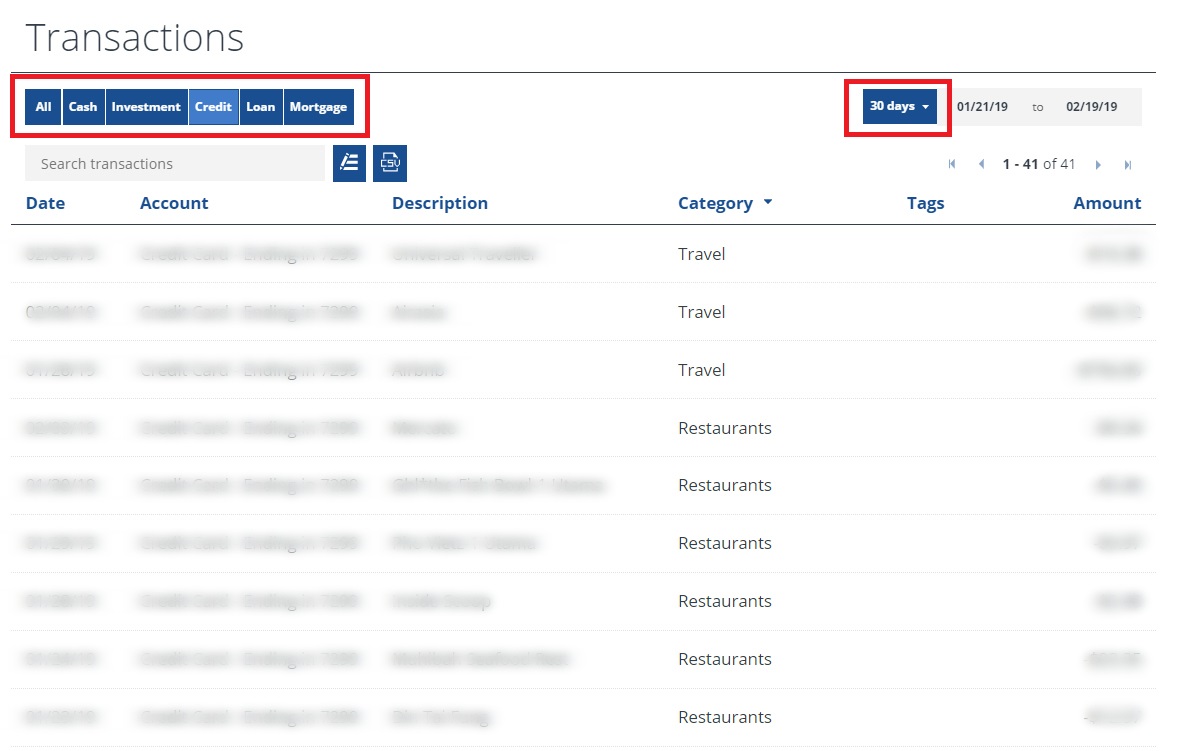

For the purposes of this review, we will only focus on the brokered CD (certificate of deposit) rates offered through Charles Schwab. To see all of Charles Schwab’s CD options you will need to login to the Schwab CD OneSource platform here or continue reading below.

It is important to keep in mind that Charles Schwab does not issue CDs themselves, but rather brokers (or re-sells) bank CDs issued by FDIC-insured banks and financial institutions.

Charles Schwab CDs require a minimum deposit of $1,000 and you may increase your investment size by increments of $1,000.

Charles Schwab Brokered CD Rates

To put these offers in perspective, the current national average on a 12 month CD sits at 0.22% APY, and top rates on 12 month CDs from online banks and credit unions still come close to 1.00% APY.

Charles Schwab Brokerage Fees for CDs: New Issue and Secondary Market

For all new issue CDs a selling concession is already included in the overall price for both online and broker assisted trades.

For all CDs purchased on the secondary market through Schwab CD OneSource, a $1 transaction fee per $1,000 is applied. This comes with a $10 minimum and a $250 maximum.

If you need a broker’s assistance for the trade you will also be charged an additional $25 as a trade service charge.

How Does FDIC-Insurance Work with Charles Schwab CDs?

All of the brokered CDs offered through Schwab OneSource are federally insured by the FDIC through the partner bank. Thus the same coverage extends to you and can even exceed the $250,000 maximum if you choose to open more than one CD with more than one bank.

For example, if you open two CDs from two different banks through Schwab OneSource, you will get FDIC coverage of $250,000 from one bank and then $250,000 from the second bank. Assuming you have no other deposits at those banks, you’re covered for $500,000.

Compounding Interest + Grace Period

Usaa Cd Rates Certificate Of Deposit

Interest on brokered CDs is not compounded as it would be with a traditional bank as it requires immediate distribution. If you want compounding interest on a brokered CD you will need to reinvest your earnings into a different account.

Charles Schwab Client Login

Grace periods with traditional banks tend to be around 10 days long. During this time a deposit holder may add to or withdraw funds without incurring a penalty. With brokered CDs you will not incur any fee for early withdrawal. If you need funds prior to maturity, a broker will help you sell it on the secondary market. The exact grace period for your deposit can be found by contacting the issuing institution.

Drawbacks and Risks

The main risk in purchasing a brokered CD through Charles Schwab (or any brokerage firm for that matter) is if you need your funds prior to maturity. As mentioned above, in this case you will need to sell your CD on the secondary market. Depending on the interest rate environment at that time it is possible to sell your CD for either less or more than you purchased it for.

Charles Schwab Brokered Cd Rates

Consider the following: You purchase a 2 year CD and need to cash out unexpectedly after the first year. During this time CD rates have also risen substantially. At this point you will likely need to sell your CD at a lower price than you purchased it for because much more attractive rates are being offered on new issue CDs.

While we’ve seen Charles Schwab offer competitive brokered CD rates in the past the current offers are less competitive than brokered CDs at either Fidelity or Edward Jones and are substantially less profitable than CDs found through actual banks and credit unions directly.

The main advantage brokered CDs have over traditional bank deposits is the ability to leverage the FDIC insurance of multiple banks. But in the current interest rate environment, this perk seems less noteworthy.